What Is the Best Fehb Plan 2021

The easiest way to save money is to find a different planand a less expensive plan may very well be. Feds looking to save money on their health insurance have a number of options.

Choosing The Right Fehb Health Insurance Plan For 2021

Eight plans are leaving the program or.

. How to Choose the Best FEHB Plan For You and Your Family. FEHB Retirees Annuitants Compare plan options and costs under Medicare. FEHB premiums will increase on average by 24 in 2022.

Once FEHB health plan coverage becomes effective on Jan. These include fee-for-service FFS plans available to all employees while other FFS plans are available to specific categories of employee. 64 rows Member Cost with Medicare A B Primary - Out-of-Pocket Maximum.

The overall average increase for non-Postal employees and annuitants will be 36. Ad Over 492000 Network Dentists. For Self Plus One the average increase is 35.

There are over 200 FEHB plans to choose from when electing coverage. Enrollment takes place during the annual Federal Benefits Open. Health Savings Account Associated with a HDHP.

Several new providers were added for the 2021 open season. Open season is the time for federal employees and retirees to ensure that they have the right health dental or vision insurance coverage for themselves and their families and make any changes needed to their insurance benefits. What is the best FEHB plan to supplement Medicare.

At this point compare the brochures of these carefully. By asking you a few questions about yourself and your family the Guide provides a personalized. Some premiums as low as 0.

Selecting the right health insurance plan is critical when it comes to. There are six new FEHB plans in 2021 including one new national plan UnitedHealthcare Advantage. Enroll in the Plan Thats With You Wherever You Are.

FEDVIP Comparisons Compare standalone dental and vision plans. Find your Medicare Advantage plan for 2022. Options at Age 65 Retired With Medicare Parts A and B and FEHB With Enhanced Medicare Advantage Option Many plans offer this benefit in 2022 See Section 9 of the plan brochure or Medicare information on plan website Two-Step enrollment Step one Enroll in an FEHB plan that offers MA option.

Combine two federal government programs and you can have even more. Since the average FEHB plan covers more than 90 percent of hospital and doctor costs and has a solid ceiling on maximum out-of-pocket costs this is a dubious. Access Plans In Minutes.

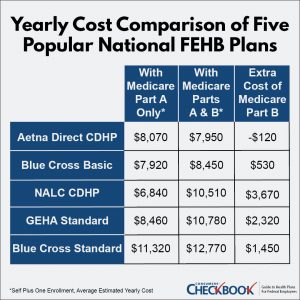

In 2021 the average enrollee share of an FEHB self only premium is about 2540 and the standard Part B enrollee premium is about 1780 so this decision almost doubles premium costs. The 2021 FEHB Open Season runs from November 9 th through December 14 th. The enrollee share will increase an average of 49.

Member Cost with Medicare A B Primary - This is the most you have to pay annually in cost-sharing deductibles copayments and coinsurance for covered in-network services in your FEHB plan when Medicare A and B is your primary coverage. Ad Get The Best Health Insurance Coverage Available At The Most Cost-Effective Rate. A 3-digit code reflecting the combination of the 2-character Plan Code and the 1-digit enrollment code.

The data we have presented should help you to quickly and easily narrow your choice to two or three of the plans out of the dozens you are offered. Government programs by themselves can be complicated. No ads or commissions means unbiased ratings.

The process begins with selecting the right Federal Employees Health Benefits FEHB program health insurance plan during the annual FEHB open season held this year between Nov. But whether you enroll in Part A or Part B depends on your income premiums out-of-pocket costs and other considerations. 3 2021 the process continues by plan enrollees making the most of what their FEHB.

Open Season Facts Open Season is November 8 December 13 2021 82 million enrollees 275 plan choices enrollees generally have at least 25 choices 18 nationwide fee-for-service plans open to all Four fee-for-service plans for specific groups. High Deductible Health Plans. Savings for self-only or any family size will in most cases be 1000 or more and for those currently enrolled in the highest cost plans 2000 or more.

Self Only 14 Self Plus One 3 6 andor Self and Family 2 5. Underline key points or parts of the plans that confuse you and compare these. For Self Only the average premium increase is 35.

A High Deductible Health Plan HDHP is a health insurance plan in which during 2021 the enrollee has a minimum deductible of 1400 self only coverage and 2800 self and family or self plus one coverages. The Government contribution will increase by 3. A Federal Employee Health Benefits FEHB plan and Medicare can be used together.

For 2022 there are about 275 health insurance plan choices offered under the FEHB. Undeniable Experience Proud providers of federal employee health plan analysis for 44 years. The Right Plan Can Help Lower Your Dental Health Care Costs.

There are preferred provider organizations PPO and health maintenance organizations HMOs plans available in most. The share of FEHB premiums paid by federal employees and. These are some data regarding the cost of 2021 FEHB premiums.

With that being said the top three carriers for 2022 are CDPHP Aetna and Blue Cross. An HSA is a tax-exempt trust or custodial account that an individual sets. Choosing the Right FEHB Health Insurance Plan for 2021 Selecting the Right Health Insurance Plan.

Save time Find a plan in minutes and see plan costs instantly. Federal Employees Dental and Vision Insurance Program FEDVIP Dental and vision benefits are available to eligible Federal and Postal employees retirees and their eligible family members on an enrollee-pay-all basis. Ad Compare plans prices and star ratings online.

Many plans have changed their catastrophic coverage this year including one plan that had a more than 50 increase. 9 2020 through Dec. The amount a member pays for health insurance usually once or twice a month depending on agency pay schedules.

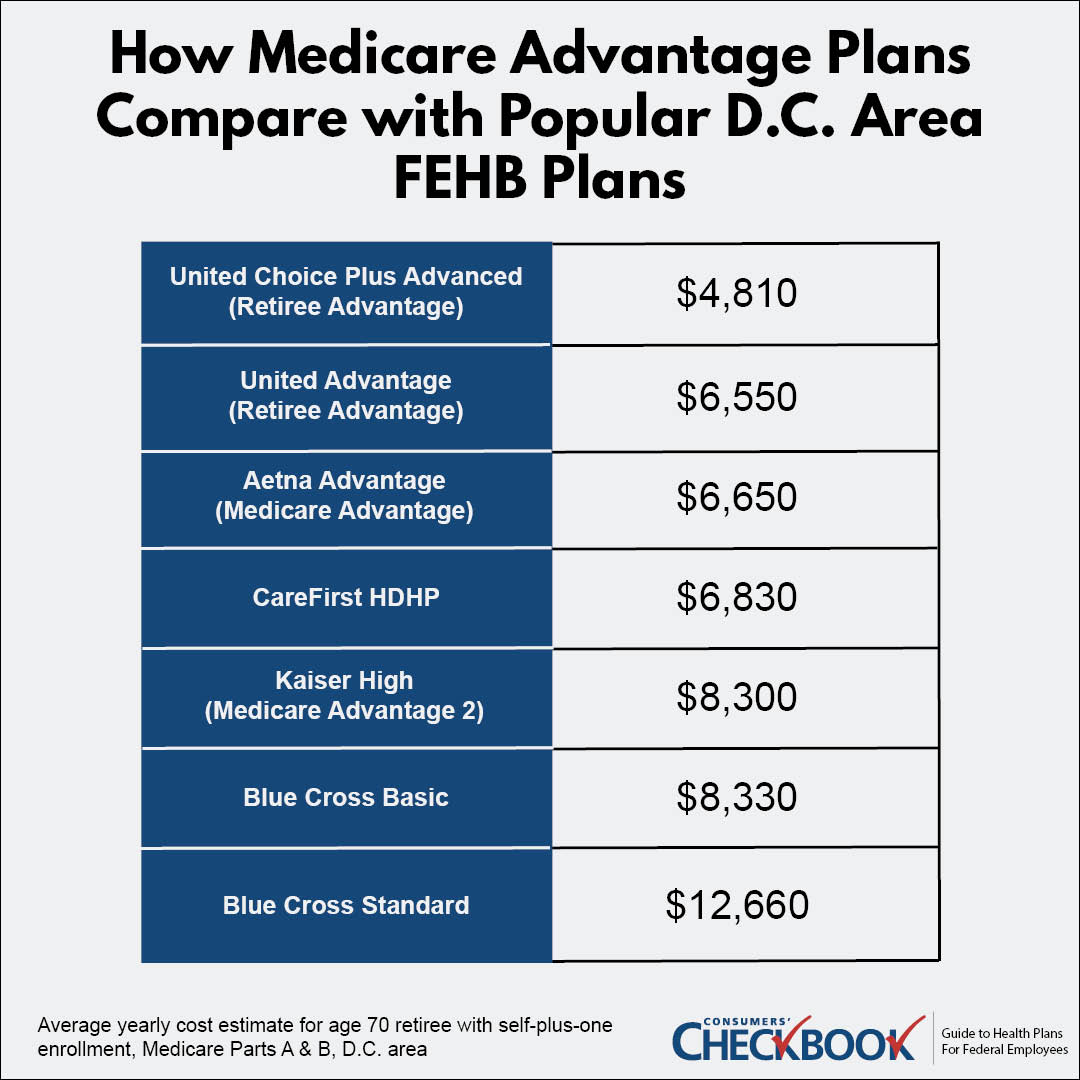

Affordable Solutions At Budget Friendly Options. For 42 years Consumers Checkbook has published our annual Guide to Health Plans for Federal Employees to help active and retired federal employees find the best FEHB plan for them. Licensed agents are standing by.

Medicare Advantage Options Available To Federal Retirees Federal Employee S Retirement Planning Guide

2021 Fehb Plan Selection Guide Federal Employee S Retirement Planning Guide

Changes For The 2021 Fehb Open Season And How To Save Some Serious Money

No comments for "What Is the Best Fehb Plan 2021"

Post a Comment